Course:ECON371/UBCO2010WT1/GROUP4/Article 4: N.W.T. floats carbon tax idea

Article 4: N.W.T. floats carbon tax idea

Summary

The government of the Northwest Territories is seeking public opinion on whether or not to introduce a carbon tax on fossil fuels, including gasoline and diesel. The N.W.T Finance Department would like to introduce a “revenue neutral” carbon tax that will allow for the reduction of greenhouse gases that are being generated by vehicle emissions and energy production facilities. Feedback is said to be required before they will proceed with any introduction of a new carbon tax.

Currently, the N.W.T do not have a provincial sales tax or a harmonized sales tax, and because of this, have been seeking options to increase revenue over the past two years. The new carbon tax would apply to fossil fuels used in transportation, home heating, and energy generation. The new tax would be introduced in addition to the existing fuel tax.

The existing fuel tax only applies to gasoline, rail and aviation fuels, and diesel. Current rates range from 1 cent/L on aviation fuel to 11.4 cents/L on rail fuel. Natural gas, propane, and space heating are currently exempt from the current fuel tax. However with the new carbon tax in place, these would no longer be un-taxed. Under the proposed carbon tax, rates would range from 1.54 cents/L on propane to 2.61 cents/L on jet fuel. New revenue of $11.2 million dollars will be generated under the new carbon tax, based on 2009-10 fuel consumption data.

Some of the drawbacks to an introduction of the new tax include higher costs to public housing units as well as other facilities that spend a large amount of their budget on heating and energy. However, along with the introduction of the tax will be carbon tax offsets introduced for individuals. This will help in decreasing the negative financial effects to public and encourage them to reduce their greenhouse gas emissions.

Analysis

Carbon Tax Economics:

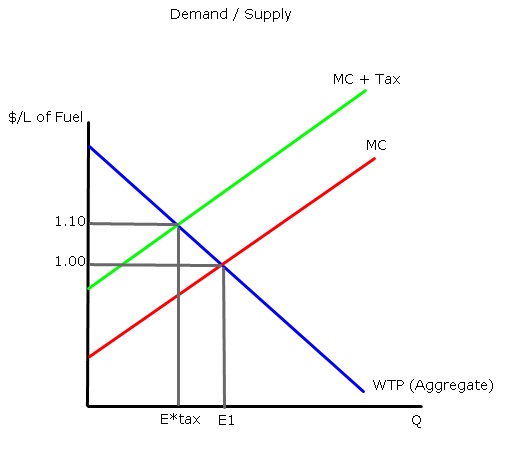

With a carbon tax, polluters will only reduce emissions as long as their marginal benefits exceed their marginal abatement costs. The carbon tax in this example is levied on a number of fuels. A carbon tax could be levied on the carbon content of all fuels, as is so in this case. The tax rate is based on the units of carbon per unit of energy. Fuels containing more carbon will face a higher tax rate than those fuels producing fewer carbon emissions. As the tax is added to the fuels, the price of these fuels will rise and reflect their carbon intensity.

As a consumer, one would respond to the increase in price by consuming less of the fuels with the highest carbon count and thus shifting the demand curve of those fuels to the left. The option of using substitute fuels will most likely take time due to the need to change energy-using technology, which is not as readily available or as cheap as most might want. (I.e. changing from a gasoline engine to a bio-diesel engine.

As we know, the introduction of a carbon tax will most likely increase prices of fuel. This will in turn increase the cost of energy required to heat a home. As the price of heating a home (especially in N.W.T) is inelastic, people will not be able to decrease their consumption of energy required for this purpose. This part of the tax issue could end up being ok with those that are in higher income brackets, but for those less fortunate, they will certainly consider this a negative aspect of a carbon tax implementation.

Seeing as the N.W.T do not have a PST or an HST, the main goal of a carbon tax would be to increase their tax revenue. An alternative would be to create an attractive subsidy program for firms leading them to invest in greener alternatives. Another route might be to create a substantial tax rebate for lower income individuals so that they are not hit as hard as they might be with an increase in the price of fuel and energy required to heat their homes. This would be more closely related to how BC acts. Their is a carbon tax rebate system in place for low income individuals and families. This would lead to a carbon tax only effecting those who could manage the increased cost. (I.e the upper middle class of society)

Conclusion

If the introduction of the new revenue-neutral carbon tax takes place, a number of things will occur. Most importantly, it will encourage the residents of the N.W.T. and their local businesses to reduce their consumption of fossil fuels in turn reducing the levels of harmful greenhouse gas emissions.

The revenue that will be generated under the new carbon tax should be redistributed back to the public and local business through income tax reductions and tax credits. However, to take advantage of these carbon tax offsets, they will have to reduce emissions under the new regulations. Overall the introduction of a new carbon tax would prove to be a positive addition to the N.W.T in their effort to reduce greenhouse gas emissions only if the government can reduce the negative financial impacts to the lower income groups who might be hit hardest by such a program.

Prof's Comments

A carbon tax would certainly hit hard for many people in the NWT, given the cost of heating, and I would guess the long distances some people have to travel. It would hit the low income people particularly hard. However, hitting low income people hard is an issue of equity, not efficiency. You should differentiate these two issues.