Course:ECON371/UBCO2010WT1/GROUP1/Article3

Back to

Group 1

Article 3: Iranian Oilmen Reflect of Gulf of Mexico Spill

Summary

The article discusses the impact of the Gulf of Mexico spill on the Iranian oil industry. Prior to the spill, Iran has had a very weak offshore spill response industry, but the occurence of the BP oil spill has caused Iran oil industry officials to reevaluate, examining how their country (Iran) would cope if a similar situation occured.

Although the Iranain government offered help to the United States to help cap the oil leak, the help was declined. This is partially because of the uncordial relationship existing between the two countries, and because of the image of incompetence it would give an industry giant like the US. Some Iranian media outlets felt the government should leave America alone, and concentrate on "problems closer to home".

The BP oil spill, coupled with an on shore oil well fire (which affected a well that had been producing at a rate 60 percent higher than the Gulf of Mexico shaft) in Naftshahr, Iran, that took about five weeks to extinguish, caused the reevaluation of the industry regarding their ability to manage such situations.

Two main recomendations resulted from this reevaluation- training experts to deal with offshore oil spills, and acquiring the right equipment for such an eventuality, two areas where the offshore drilling sector is lacking. The equipment would either be manufactured in Iran, or sourced abroad. This is despite the fact that the Iranian workers are purported to be experts at putting out fires -experience they gained during wartime- even though their methods might be dated.

The recommendation that Iran should use more modern technology in battling such situations is encountering problems. The UN sanctions that have been imposed on Iran since June has prevented them from importing the modern technology that will aid them in containing leaks. Another problem is Iran's failure to retain skilled workers, because of rivals who pay the workers considerably more. Add the fact that the Iranian drilling industry's safety record is poor by international standards, and we have a major problem.

The bottom line: Iran has to deal with their own shortcomings before they're even capable of helping others.

Analysis of Article

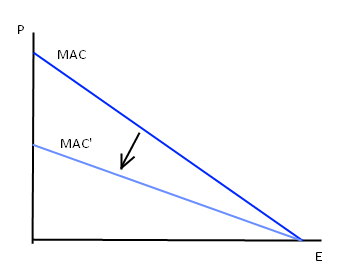

Onshore oilfield fire are not constant emissions but rather expected damages, so this will not affect the marginal abatement cost and marginal damage curves. But the investment in new technologies will rotate the marginal abatement cost curve inward around the horizontal intercept, while the emission level will remain unaffected.

From the article, it is clear that Iran had little incentive to adopt new technologies and has failed to retain skilled labor with higher wages. As Iran's offshore drilling sector relies heavily on foreign companies to supply it with it's machinery, it is more difficult and expensive for them to obtain new pollution-control technology.

However, the Iranian government should impose technology-based standards, which includes design standards or engineering standards to better prevent future oil leakages. As well, ambient pollution standards should also be examined in order to keep a better record of existing and future pollution. Being able to maintain records of the oil sector, will allow for the future analyses to be more precise.

Sarafraz argues that the Iranian government should focus more on domestic investment on labor, education, and technology while reducing their concerns for international problems. By investing domestically, Iran will experience more growth in terms of GDP, and reduced unemployment. Investment in new technology will hopefully increase safety levels, and decrease Iran's dramatically high worker death rate (20 per million hours worked). Investment in education, or the training of experts will reduce the chances of an onshore (or offshore) oil disaster, and decrease the time required to deal with the problem. Ultimately the country’s labor force will be better off with more domestic investment which will result in higher national productivity.

While investing domestically, the government should consider a trade tariff toward wealthy nations specifically to secure domestic skilled labor. Since the international relations between Iran and many wealthy nations are already unfriendly, the trade tariff will not affect Iran’s economy severely. In short run, this trade tariff may be costly and reduce outputs. While in the long run, working conditions and the amount of efficient labor will increase, which will balance out the loss from the short run.

Conclusions

Sarafraz argues that the world’s most wealthy nations are more than capable of solving their own problems so Iran should focus more on domestic issues; such as education and technology. The governments in Iran should stop investing time on superpower nations and develop new regulation to protect domestic skilled labor and import new technologies. Imposing new regulations such as trade tariffs, specifically towards wealthy nations, will affect Iran's economy in the short run but in the long run, labor, capital and productivity will increase to balance out the loss from the short run.

The United States imposed trade tariffs which made it more difficult for Iran to import equipment, thus Iran should reconsider it's investments in other wealthy nations.

Prof's Comments

You are right that the issue here on the damage side is expected damage, not actual damage. One can still draw a marginal damage curve though, which represents expected damage.

On the abatement side, you have tried to frame things as an MAC issue. One could look at it a bit that way, but it is still problematic, because we are not dealing with emissions as such, but rather with the risk of a spill. A better dimension along the horizontal axis would be different levels of precaution. The less precaution purchased, the greater the risk of a spill and therefore the greater the expected damage.

The idea of making it more difficult for workers to leave is interesting. Such export tariffs are generally frowned upon, because they interfere with people's mobility - a barrier to free trade. Iran may also not want to use policies like this, because foreign workers often sent a significant amount of money back to their home country.