Course:ECON371/UBCO2009WT1/GROUP6/Article3

Group 6: Carbon Tax in Canada

Article 3: Little Damage From Carbon Tax, Report Says

Complimentary Reading: MKJA Report - Cost Curves for Greenhouse Gas Emission Reduction in Canada: The Kyoto Period and Beyond MKJA Report - Executive Summary Richard S.J. Tol - The Marginal Damage Costs of Carbon Dioxide Emissions: An Assessment of the Uncertainties Gerrit Cornelis Van Kooten - Climate Change Economics: Why International Accords FailGreen Party Tax Shift

Summary

Elizabeth May, the federal Green Party leader, through the access to information act, received a report that was originally presented to the Conservative government's Office of Energy Efficiency on Jan. 16 2007. The report by Mark Jaccard and Associates analyzed the potential impacts that a range of different prices on greenhouses gases, between $10 to $250 per tonne, would have on gross domestic product. Elizabeth May claims the report not only goes to counter the Conservative position against a carbon tax but also offers support for the Green Party's proposed $50 rate on each tonne of carbon. It was shown in the report that though $50 was found to lower GDP for more than a decade, by 2020 GDP would be once again increasing. Instead of a carbon tax, the Conservative government has promised a trading discharge permit (TDP) system with an estimated price of $15 per tonne; the Liberals have proposed a similar plan with a $20 price per tonne and an emphasis on incentives for technology innovation.

Analysis

The Fallible Mr. Currey and Miss May

Contrary to the article in the Globe and Mail, the report that was prepared by MK Jaccard and Associates (MKJA) does not claim that a possible carbon tax would cause little economic damage. One could argue that the report shows a $50 tax on emissions would cause little financial hardship, but in not including an analyis of economic welfare, including costs and benefits, the report does not reach any conclusions that estimate net economic damages or benefits. The news article states:

" An internal report prepared for the Conservative government reveals a carbon tax as high as $50 per tonne of greenhouse gas emissions would cause little economic damage and would actually provide a small boost down the road."

Bill Currey wrote this article with the perception that a decrease in GDP is the only criterion on which to judge whether a certain price of carbon is damaging to the economy and in reading the report, seeing Table 6 (see right),

he concluded charges of $50 and below were less harmful than if the charges were higher. Elizabeth May and the Green Party also interpreted the report in the same fashion, which consequently made the report offer defacto support for the Greens proposed policy of a $50 dollar price on carbon. Mr. Currey and Miss May are in error though, for the report only developed and analyzed cost curves and compared the effects different charges on carbon would have on Gross Domestic Product (GDP), it did not conclude which price on carbon was the most efficient nor did it say only the impacts on GDP would be the deciding factors. Certainly the quantity emissions are reduced plays a role, as well as the consequent benefit to the environment and society in general; the MKJA report however does not take any of those factors into consideration. Instead of an economic analysis, the report provides only one that is financial. It is problematic for anyone to suggest any price on carbon is better or more damaging based on the MKJA report because each price's net social benefit is left undetermined. Though reductions in GDP are harmful, a policy's effect on GDP is only a small part in evaluating the economic damage a policy inflicts, the greater analysis must take into consideration all the costs as well as all the benefits, something Mr. Currey and Miss May overlooked.

Inefficiency as an Indicator of Economic Damage

Efficiency is an important criterion for evaluating any economic policy. A policy is efficient if it balances costs with benefits. In the situation of a charge on carbon, the point where marginal abatement cost (MAC) equals marginal damage (MD) is the equilibrium point (E*); this is the best an economy can do given its resources, at this location social net benefit is maximized. In Figure 1 (see right) MAC equals MD at a charge on carbon of $50 per tonne and an emission level of 623 Mt CO2 per year (Data was drawn from pg 15 of the report). Prior to abatement, MAC=0 and emissions equalled 659.3 Mt CO2, which resulted in cost to society in the form of damages consisting of area (a+b+c). When MAC equals MD, though area (a+b) remains as a cost to society (area a as damage from emissions and b as abatement cost), area c is prevented damage, thus no longer a cost; this reduction in costs for society increases its net benefit by area c.

It is important to note that the MKJA report refrained from including any data on damage produced from GHG emissions. The report only developed cost curves and estimates of the impacts that differing GHG charges would have on GDP. Table 6 (see right) compares a range of carbon prices and their impacts on GDP in different points in time. The report explains that by increasing costs, higher carbon charges reduce GDP. On the otherhand, lower carbon charges up to 50 dollars per tonne, have less of an impact, some are even shown to be increasing GDP in later years. Though these lower charges are better in terms of impacts on GDP, because there is no inclusion of information regarding the reduction in environmental damage (ie the benefits) there is only the costs to consider. As efficiency depends on balancing MAC with MD, the reports exclusion of damages leaves it unclear which charge on carbon, including the higher ones, is the most socially efficient.

Efficiency in the Balance

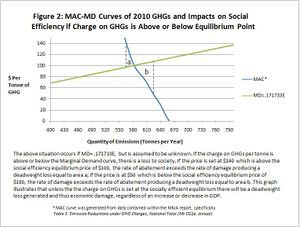

With the marginal damage curve not included in the MKJA analysis, it is presumptious to suggest solely on the basis of the report that carbon charges of $50 and below are less economically damaging than higher charges. Figure 2 (see right) offers an example of a situation where the social cost, a loss in efficiency, could outweigh any positive impact a certain price of carbon could have on GDP. The graph contains a MAC curve generated from data provided in Table 3 and a hypothetical MD curve that equals 0.171733E. This theoretical socially efficient equilibrium or E* is at a carbon price of $100 per tonne and an emissions level of 582 Mt CO2. Assuming MD is not included and a price on carbon is set higher than the real equilibrium price at $140 per tonne, abatement costs would be greater than the damages that are reduced producing an excess burden also known as a deadweight loss equal to area a.

On the otherhand if the price on carbon is set lower than the hypothetical equilibrium point, at $50, there would be higher emissions which would cause an excess burden on society in the form of environmental damages equal to area b. Figure 1 illustrates that in setting a price on carbon, consideration of marginal damage must be made or significant deadweight loss may result which would reduce social benefit. The deadweight losses generated from carbon prices that are not at the socially efficient equilibrium may make those carbon prices more economically damaging than just their effect on GDP would indicate. A price on carbon may increase GDP however it could also produce such a deadweight loss that other more efficient carbon prices would be preferred. Without consideration of marginal damage it is erroneous to suggest certain prices of carbon are more or less damaging to the economy.

Where the MD Lies

The MKJA report avoided including an MD curve, most probably because of the difficulty of obtaining one. Richard S.J. Tol in a 2004 Energy Policy journal contribution titled The Marginal Damage Costs of Carbon Dioxide Emissions: an assessment of the uncertainties, discusses the challenges in determining a marginal damage curve and compares 28 studies of the marginal damage costs of CO2 emissions. The problems he identifies in determining an MD curve for CO2 emissions deal with the understanding of the impacts of climate change on local/regional areas and developing countries, as well as the role of adaptation and other socio-economic trends. Richard Tol also adds that differences in discount rates and equity weighing conflate estimates and uncertainties leading to greater difficulty. Most of these problems require value judgments, and those are often controversial. Tol avoids making those type of judgments and mitigates other difficulties by comparing multiple studies and arriving on at least a limit to where the MD curve lies. On page 2073 he concludes:

"One can therefore safely say that, for all practical purposes, climate change impacts may be very uncertain but is unlikely that the marginal damage costs of carbon dioxide emissions exceed $50/tC and are likely to be substantially smaller than that."

It should be observed that this determination is of global marginal damage; and though CO2 affects the whole world, it also has more immediate effects on smaller regions which makes using this calculation for an individual country problematic. Tol's work does go to show however the difficulty in calculating marginal damage.

The Evaluating Criteria

To assess Elizabeth May's Carbon Tax policy, we can consider its responses to Field and Olewiler's "Criteria For Evaluating Environmental Policies" (Environmental Economics, pg 177-184).

The first criteria is concerned with efficiency and cost effectiveness. Since an efficient cost is where MAC=MD, the cost per tonne of carbon should be at this point. Unfortunately, it is very difficult to locate an MD curve for carbon emissions. Any predictions about its effects are not completely accurate, therefore the cost effectiveness of a policy may also be evaluated. If a target level of emissions is chosen, than a policy is cost effective if it can lower emissions to that level, for the lowest possible cost. The Green Party plans to cut carbon emissions down to 30% below the 1990 levels by 2020. If the 1990 level of greenhouse gas emission was 573 817 kilotonnes, than the 2020 goal of emissions is 401 672 kilotonnes.CANSIM Table Showing Canadian Greenhouse Gas Emissions The Green Party's policy is cost effective if it can reach this goal, at the lowest possible cost.

The second criteria depends on fairness. This is not normally an economic concern, but economic policies affect people who care about equality. A carbon tax system affects everyone who emits greenhouse gases. In the situation of a low income family living in a rural area, public transit is inaccessible. This results in a higher proportion of their income going towards gasoline and therefore a higher proportion of their expenditures will be affected by a carbon tax. To offset this inequality, the Green Party plans to provide those living in rural communities with tax rebates. They also plan to cut income taxes on lower income households, to balance out any negative effects that a carbon tax may cause.

A policy must provide incentives for innovation. It must favor technological progress and reward substituting away from polluting activities. A carbon tax encourages consumers to substitute away from using fuel. The Green Party's Carbon Tax responds to this criteria because it encourages Canadians to find substitutes. The policy's goal is to reduce carbon emissions, so when people substitute away from environmentally hazardous behavior, this goal is satisfied. The incentive provided is that the less fuel you use, the less you will be taxed. This encourages people to take public transit, to carpool, to walk or ride their bikes, to invest in more fuel efficient cars, and in doing so, reduce their own emissions. Large corporations are encouraged to invest in technological progress that will lower their emissions, and thus lower the amount of tax that they will have to pay.

A policy may set certain standards, but they must be enforced for the policy to be effective. This depends on the government monitoring the population to assure that the policy's new guidelines are being followed. They must also provide proper sanctioning to those who choose not to abide by the rules. With a policy such as a carbon tax, it is fairly easy to monitor how consumers are responding. They are either paying the tax, or they're not. The government actively monitors tax revenues, so those generated by an emissions tax should fall under the same surveillance.

Although economics is often more concerned with efficiency, rather than equality, a policy must be morally acceptable. Does it respond to innate feelings of right and wrong? Although a policy is efficient, perhaps it is believed that there should still be fewer carbon emissions. It may result in a dead weight loss, or higher abatement costs, but it will provide an environmental quality that will actually be effective in reducing global warming. Global warming is a serious problem, and the time we have to respond to it is completely uncertain. The Kyoto Protocol represents a set of emission reduction targets that have been agreed upon by certain members of the United Nations. It therefore describes emission targets that are considered to be acceptable. This protocol expects emission levels to be lowered by 30% of their 1990 level, by 2020, a goal shared by the members of Canada's Green Party.

Conclusion

Tax, Permits, and Slope of MAC

Though the report does not distinguish between a tax on carbon or a system of tradable discharge permits, in determining which policy is best, the slope of the MAC curve must be considered. Gerrit Cornelis Van Kooten in Climate Change Economics: Why International Accords Fail admits that, in theory, a tax and a permit system produce the same effects; however in reality he suggests that depending on the degree of uncertainties, a tax on emissions is best for a steep MAC curve while a permit system is better for a flatter one.

Figure 1 from above-right displays a steep MAC curve generated by information contained within the MKJA report. Based on Van Kooten's opinion and data from the MKJA report, since the MAC curve is steep it would appear that a carbon tax would be the better policy for Canada. If that is the case than both the Conservatives and the Liberals should seriously re-evaluate their proposed cap-and-trade systems.

In conclusion the report done by Mark Jaccard and Associates is almost purely concerned with possible financial impacts of various prices on GHG emissions and not the impacts on total welfare. By not considering environmental damage abated and other benefits, the work done appears to be a half completed cost-benefit analyis. Though it includes information relating to a possible cost-effective approach, it excludes a target in emissions enabling a comparison of costs. In the end though the report gives data that appears to illustrate a steep marginal abatement curve, which does offer justification for a carbon tax. However the report does not suggest which price on carbon is the most beneficial economically, instead only going as far to suggest which prices are the least financially damaging. A more detailed economic endeavor, based on a complete cost-benefit analysis would be the preferred method to find what price is the least economically damaging and the most social efficient, .

Prof's Comments

The results of the analysis are an estimate of the total economic 'abatement cost' for various different emissions tax levels, and from this one can get a marginal abatement cost curve. However, whether or not it is efficient is definitely a question of where the marginal damage is.