Course:ECON371/UBCO2010WT1/GROUP5/Article 4

Back to

Ecuador Agrees to Keep Amazon Eco-Treasure Free of Oil Drilling

Summary

In order to protect Yasuni National Park in Ecuador, the government of Ecuador and the United Nations Development Programme have agreed to establish a trust fund, which collects payments to Ecuador government, in compensation for its forgone revenue from drilling the oil under the 10,000 hectares. It is also estimated that about 400 million tonnes of carbon dioxide will be spared from entering the atmosphere, something that Ecuador's Heritage Minister María Espinoza calls, "Ecuador's contribution" toward reducing averse climate change. In addition, under this agreement, the biodiversity in the Yasuni region, which contains thousands of rare and endangered species, will be safe from the destructive practises of oil drilling and clear cutting, as well as maintain the moisture that the region provides. However, there's some concern on this agreement, as conservation groups fear the government may turn to old places other than the Yasuni for oil drilling- transferring the damage. Overall, the agreement is hailed as a victory for Ecuador, and the United Nations Development Programme, in charge of brokering the deal, hopes to replicate it in other regions of the world.

Analysis

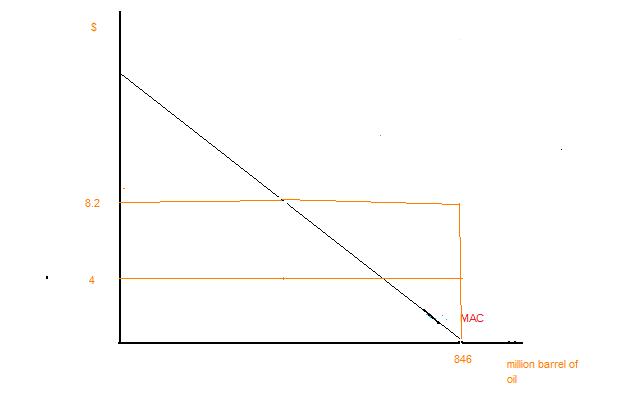

This article is centred around liability laws, a similar theme to article 3: Legal Opinion: Brazil's Amazon Tribes Own Carbon Trading Rights. It covers comparable aspects on property rights, in the previous article the native Surui tribe were attempting to seize their legal property in order to rightfully reap the benefits of the 600,000 acres themselves. In Ecuador's situation, the government owns the property right to the national park, thus its oil supplies. The payment received by the government from the trust fund is like a subsidy. Ecuador is forfeiting 846 million barrels of oil which is equal to an estimated $7 billion, therefore, in order to totally compensate the economic loss for the Ecuadorian government, the subsidy price should be set at 8.2 dollar per barrel. However, the expected payment from the trust fund is set to amount to $3.6 billion, thus only $4 per barrel foregone.

This may stem from two main reasons; firstly the oil is still a private property right of the Ecuadorian government, therefore the economic loss of $7 billion is potentially overestimated. Secondly, the total damages reduced by this action, for example the reduction of 400 million tonnes of CO2, provides some economic gain. As stated in the article foreign subsidies are accountable for $1.5 billion in this project, thus, still leaving a gap between the expected payment of 3.6 billion. This discrepancy is a possible result of the ‘hot-spot problem’. Since the damage has a more direct impact on Ecuador, than foreign countries based further away from the source of the pollution. Thus, foreign countries may not be willing to pay as much toward the prevention of its emissions, leaving a gap of over 50% of the total expected payment, which should be filled by local Ecuadorian citizens.

File:Equadorian oil drilling 2.pdf

This portrays that the equilibrium price to be paid to the Ecuadorian government is $3.6 billion, which is the amount they must receive to make this project worth their while (not $7 bill. due to reasons above). It also depicts that the subsidiary of $1.5 billion by foreign investors is not a sufficient amount to prevent the Ecuadorians using the land as an oil base, although it would encourage them to reduce the amount of oil barrelled, it would not take them down to the equilibrium. Therefore, suggesting that it still requires more investment before the Ecuadorian government commit, potentially from internal or more external resources.

Conclusion

Therefore, this shows that although there is a significant drive toward reducing carbon emissions and preventing destruction of the amazon rainforest, thus the loss of many endangered species. The unfortunate 'hot spot problem' arises and foreign countries simply do not feel the effects of the externalities enough to contibute sufficiently. Those outside the immediate zone do not realise the cost of leaving it, when emissions are being produced and rainforests cut down, or the benefits of protecting it, reducing CO2 levels and saving a bio diversity. Henceforth, are unwilling to subsidise the equadorian government enough to prevent them drilling for oil.

Prof's Comments

An important thing to recognize in this article is the ideas of the Coase theorem. Ecuador has an oil resource it can extract. To do so would generate a certain amount of revenue - estimated at $7 billion. However, it would also cause damage in Ecuador - destruction of habitat, etc. - Ecuador is negotiating with the international community, represented by the UN, to extract a payment that would make it worth its while not to extract the oil.

Of course, there are uncertainties, as there is no guarantee in the international forum that Ecuador will always honor this commitment.