Course:ECON371/UBCO2010WT1/GROUP2/Article3

Back to

Group 2: The Environmental Impacts of Natural Gas Extraction

Article 3: Gov. Ed Rendell wants lawmakers to meet on Columbus Day to hammer out a Marcellus Shale tax agreement Goldilock's approach: State needs middle ground on Marcellus Shale tax

Summary

The state of Pennsylvania wants to impose a severance tax on natural gas extracted from the Marcellus Shale. On September 29, 2010, the House of Representatives passed a bill proposing a tax of 39 cents per thousand cubic feet, which translates into roughly 8.5% at current gas prices. This proposed tax rate may be one of the highest in the USA. The bill has now been passed to the Pennsylvania senate which will have three days to debate, amend, and pass the bill before the November 2 election.

The article argues for the government to adopt a middle-ground approach. This may be achieved by either A) instituting a tax of around 6 percent or B) a 2% tax for the first few years followed by an increase to around 7 to 8%.

Option A is a relatively balanced tax rate in relation to the rest of the United States. This would allow Pennsylvania to remain competitive nationally and regionally, thus not driving away potential investment by natural gas producers. Option B is appealing due to the high productivity of wells during the first few years of operation, which then declines as natural gas reservoirs are depleted. Therefore, the tax described in Option B allows the firm to satisfy its start-up costs while making profit in the initial years.

The article argues that there would be negative effects upon the Pennsylvanian economy if it were to impose a tax that was either too high or too low. A high tax rate would cause lower demand by national and international consumers and thus, would cause a stagnation of the state’s economic growth. A low tax rate, in contrast, would cause consumers to purchase from Pennsylvanian industries causing a high output, which could potentially lead to high pollution. In addition, the Pennsylvania government will not collect the highest attainable revenue if tax is not high enough.

In the opinion of the article, a ‘state-by-state comparison’ of current taxes should be used to best arrive at a conclusion that favours a middle-ground rate. An open discussion between politicians, communities, and the industry could also lead to a tax near the ideal rate.

Analysis

A severance tax on extraction of natural gas in Pennsylvania is a second best alternative to an emissions tax since emissions caused by natural gas consumption cannot be closely monitored. It is intended to not only raise government revenue, but also to reduce the environmental externalities of natural gas extraction by making it more expensive to extract, thus slowing down the production. However, the government must be careful about the rate it selects. A rate that's too high will cause producers to pull out of Pennsylvania. This will lead to a decrease in government revenue, which was to be maximized by a high tax. A rate that's too low will encourage investment in Pennsylvania. As producers extract more natural gas, they cause an increased environmental degradation. There will be more wells drilled and built, which increases the potential for water pollution from the hydraulic fracturing process, and will lead to aesthetic degradation of the area.

However, there is an ideal tax rate which the producers are willing to pay. At this tax rate, producers will not withdraw investment out of Pennsylvania and the government will raise the highest attainable revenue. In theory, the severance tax will be passed on to consumers in the form of higher prices. Quantity demanded will decrease, leading to reduction of output. A decreased output will cause the MAC curve to shift in. Thus the efficient level of emissions, as represented by the intersection of MAC and MD curves, will become lower.

A severance tax will also raise government revenue. A portion of this revenue can be used to invest in environmental improvement. Thus, the positive effect of the tax on environment will be compounded.

Social Costs:

There are costs to the society if the government imposes a tax agreement by following option B. The social costs would be larger for the first couple years. Since the first two years are the most productive for the natural gas companies, and if the tax is around 2%, the companies would do a lot of drilling to bring out a large amount of natural gas, which means more emissions. The public will have to suffer from water and other environmental pollutions until the severance tax goes up.

In the other case, where the tax is too high, the price of natural gas will go up. Society will have to pay a high price which will lead to a lower quantity demanded of natural gas.

Social benefits:

First of all, there are private benefits to the firms. If the government uses Texas’ approach (option B), then the firms will earn a lot of profit for the first one or two years which will then decline when the government imposes high tax. However, the public can enjoy the low price of natural gas in the initial years.

On the other hand, the profits to the society are large when there is a high tax to the natural gas industry. Because higher tax means there are limited emissions from producers, the society can experience less environmental pollution.

Government Policy:

If the government does not know where the marginal abatement cost and the marginal damage curves, or the efficient level are, it can start with an average tax rate between 5% - 7.8%, and then adjust the severance tax depending on where the emission level is. The second option is setting a limit on the amount of emission. However, if emission standard is too low, the firm would just pay the fines but still polluting the same amount as before, because the profits would be larger than the fines from the firms’ view. The third option is the Texas’s approach, where the tax starts at 2% and then jumps up to 5%-7.8%.

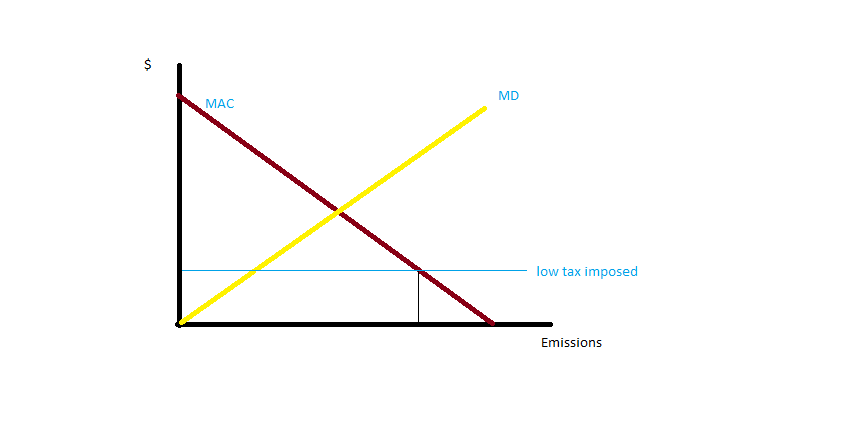

When the state imposes a low tax rate to the natural gas extraction, the polluters would rather pay the tax and pollute the environment than reduce emissions.

When the state imposes a low tax rate to the natural gas extraction, the polluters would rather pay the tax and pollute the environment than reduce emissions.

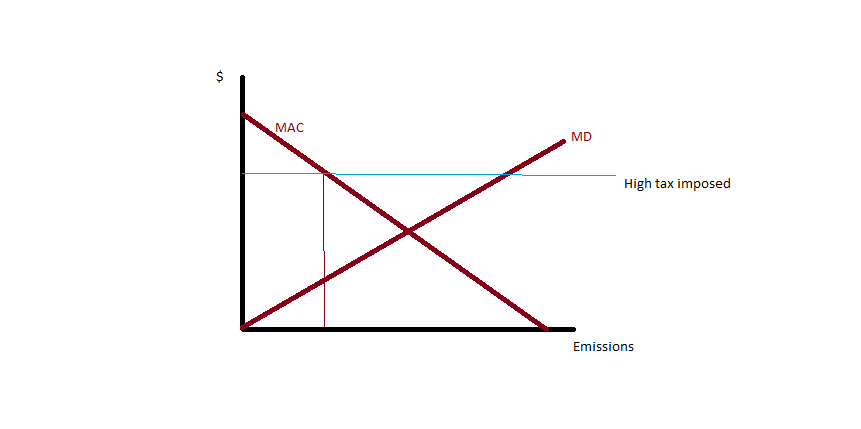

When high tax rate is imposed, the firms would produce less natural gas then the efficient level. The firms would have less incentive to extract gas since the costs are too high.

When high tax rate is imposed, the firms would produce less natural gas then the efficient level. The firms would have less incentive to extract gas since the costs are too high.

Prof's Comments

Be careful with your graphs. The tax is not an emissions tax, but a severance tax. You are right that it is a sort of second best approach to emissions reduction, as it puts the tax on the production of natural gas, not on the production of emissions.

You can look at it as having an impact on emissions indirectly, by impacting on the size of the industry and the amount of natural gas extracted and burned. You do mention this, in the context of the abatement cost here including losses to the state government that would occur if the firms leave.