Course:ECON371/UBCO2009WT1/GROUP4/Article3

Group 4 - The Environmental Impacts of Agriculture in British Columbia

Article: [1]

Canadian Biofuel Seen Rising 76 Pct in Two Years (September 25, 2009)

Summary:

The Canadian government is using subsidization, targeted at ethanol production companies, as a policy tool encouraging increased production of Canadian made ethanol. Corn and wheat generated ethanol when mixed with petroleum (up to 22% in some Countries like Brazil) displaces a non-renewable resource (petroleum) with a renewable one providing a net reduction in green house gases. British Columbia, along with other Provinces, have drafted biofuel mandates to take effect over the next few months.

In addition to providing corporate subsidies, the Government of Canada is also changing Federal law - requiring gasoline to have a minimum of five percent renewable-fuel content by 2010. The Province of British Columbia has also mandated that by 2010 gasoline and diesel used in British Columbia must contain a minimum of five percent renewable content. Furthermore, the Province is taking decisive actions to reduce 33 percent of greenhouse gas emissions by 2020.

Mr. Nickel writes in his article that the increased production by 2011 will be a significant 76% increase in Canadian ethanol. The new level of ethanol production will total 660 million gallons (15.7M barrels of oil equivalent) per year.

Twenty-three companies have received funding to date with the recent corporate benefactors including Husky Energy of Saskatchewan and Methes Energies Inc of Ontario.

The subsidy totaling $1.5B (cnd) has been designed to be paid out over a period of nine years, calculated on a per-liter basis of ethanol produced. In weak market conditions the subsidy increases - paying more to ethanol fuel producers. The Canadian government subsidies correspond to new California state legislation requiring low-carbon fuel, providing a significant market demand for ethanol.

Analysis:

Social Benefits:

As the mandate that BC has passed takes effect, the resultant increase in demand for biofuels will drive up the price up the raw materials used. The raw materials are wheat and corn in the case of Ethanol and animal fat, soybeans, and canola in the case of biodiesel. Those farmers that currently produce these products will maximize production and those that can easily switch to producing them will do so.

If the raw materials for fuel are grown locally all costs associated with transportation will be eliminated or reduced. This includes the emissions from transporting fuel as well as the environmental and economic cost of disasters such as oil spills. Using biofuel also reduces the costs associated with mining and refining oil and gas and dependence on foreign oil. Furthermore net GHG’s emissions from biofuels are lower than that of conventional fuels. This is because the carbon which they possess has been taken up from the atmosphere or other carbon sinks that are closely linked to the atmosphere rather than from carbon sinks locked up in lengthy geologic cycles.

Social Costs:

So how significant is the output generated by a federal stimulus program of $1.5 billion dollars? The total Canadian ethanol production, anticipated to reach 15.7M barrels over the next couple of years is a relatively small volume of fuel. To put the number in context, according to the CIA's World Factbook, the US consumed 20.7 million barrels of oil per day (2007 numbers). So, the recent Canadian subsidy of $1.5 billion will enable Canadian manufacturers to produce the same volumetric quantity of ethanol, displacing approximately 18.2 hrs of US oil consumption.

Some argue that the utilization of food stock, in a world that has people suffer due to malnutrition and hunger, for the production of fuel is an unethical use of resources. Today, Canada produces close to 8.2M barrels of ethanol - equating to approximately 3.4M tons of wheat.

Others argue that the externalities associated with ethanol production including the environmental damage associated with increased fertilizer applications, pesticides, and green house gas production during the process of generating ethanol reduce the effectiveness of such policies targeted to reduce anthropogenic green house gas production.

Government Policy:

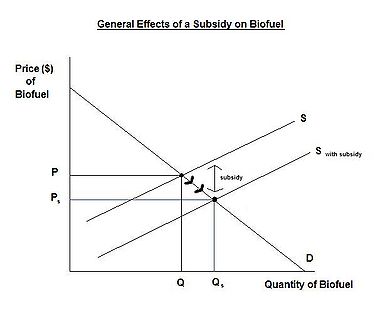

The federal and provincial governments are using a combination of policies that are designed to stimulate biofuel production and reduce our reliance on fossil fuels. The combination, in this case, is the use of subsidies and regulation to achieve their goals. Subsidies are often criticized for creating market distortions and leading to social inefficiency, however when applied in certain situations they can increase net social benefits. The characteristic of a subsidized good that governs the social success or failure of the subsidy is the nature of its externalities. The federal government must be confident that biofuel production wields enough social benefits to outweigh the social costs that will arise due to the subsidies and the increased output of biofuel. For this to be true, biofuel must exert a net positive externality on society. The subsidy would then internalize the true marginal benefit into the social equilibrium curves and serve as a Pigovian subsidy by maximizing social utility. As previously discussed, there are many social benefits and some significant social costs associated with biofuel production. The Canadian government would have had to carefully weigh these benefits and costs to ensure effective subsidization leading to a socially efficient equilibrium. Regulation is another important tool that the two levels of government are using to promote biofuel production. Here, the regulation is a performance standard regulation that requires that gasoline must have five percent renewable-fuel content by 2010. Performance standards are valuable as they allow firms to choose the best way of achieving the target constraints. However, they are often hampered by high monitoring costs and they are fairly difficult to enforce in practice. By combining subsidies and regulation, the federal and provincial governments are trying to initiate innovation in the market and spur the production of biofuel in Canada. Another policy that could be used is the increased taxation of non-renewable fuel production. This would have the reverse effects of the subsidy and would attempt to internalize the social costs of fossil fuels into the social equilibrium curves. As a result the price of fossil fuels would increase and output would decrease. If biofuel production does in fact have net positive social benefits, the levels of government are indeed acting responsibly on behalf of the populace in utilizing these two policies.

Prof's Comments

The balance in biofuels - good or bad for the environment - is under debate. I would have liked to see the difference between the private and social marginal cost curves in your figure.