Course:ECON371/UBCO20010WT1/GROUP3/Article8

Summary

It has already been a couple of months since the oil spill that devastated the Gulf of Mexico and the damages done to the surrounding environment continues to accumulate. So far, BP has taken a charge of $32.2 billion to cover the $20 billion it was paying to an escrow account that includes the costs associated with shutting down the well and as well as cleaning up after it as a form of compensation to the local community.

However, despite the reported high costs associated with the clean up process, BP still expects to be hit with several more fines on top of those already imposed under the Clean Water Act. Thus far, BP has been taking on the majority of the costs from the spill, however they believe that they should not be solely responsible for the accident and has requested from its partners in the Macondo well, Anadarko and Mitsui Oil Exploration to be liable for 35% of the costs ($4.3 billion) of the accident as that was their share in the venture. In response to the request, Anadarko accused BP of grossly negligence towards its operation of the well and therefore liable for the costs alone. In conclusion, the investigation is still on-going for BP’s role in the disaster and this aspect of the disaster is going to take a long time to settle.

Economic Analysis

Point Source Pollutant – In my opinion, the gulf spill is definitely a point source pollution from the BP wells. As a result, they are fairly easy to measure and monitor the extent of the damage caused. Since they are considered the sole polluter, it is only fair that all clean up costs be directly towards BP. There is an absolutely common sense property rights argument that should be applied to the whole matter – You can’t dump garbage on your neighbors lawn. Likewise, you can’t dump oil all over the ocean and coast and not expect to pay to clean it up and pay full damages. In addition, as there are so many industries near the gulf area, namely tourism and fishery, the property rights can be quite complex. Thus, the marginal damage associated with this disaster can be underestimated.

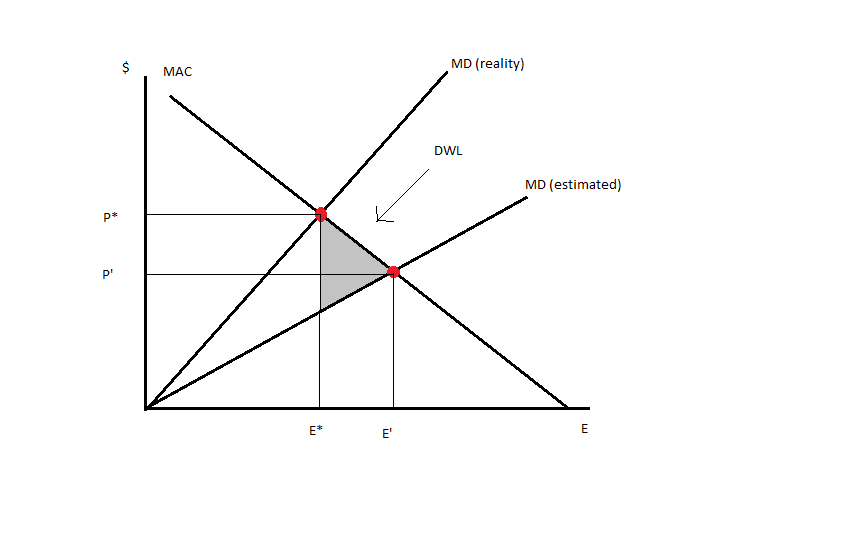

Uncertainty about the MD curve – The marginal damage caused by the oil spill in the gulf would be quite difficult if not impossible to get exactly correct. As stated in the article, BP expects more fines to be coming their way which illustrates the uncertainty with the damage caused.

According to the graph, when MD is underestimated BP would be paying P’ as their cleanup cost which is significantly lower than the P* which is the point of social efficiency where BP’s MAC curve would intersect with the real MD curve. Since the current state of the situation is underestimated, the consequence would be a loss of social welfare in the economy measured by the grey area on the graph. This loss represents the loss of welfare of people who are in some ways affected by the oil spill and not properly recompensed.

Conclusion

In conclusion BP is portrayed as a point source pollutant responsible for the oil spill; therefore there is no escaping the costs of the accident. However, since the other 3 firms are in a joint venture with BP, I think that it makes sense for them to pay as well, which can also move the economy into a more efficient state. Nonetheless, I know how impossible it is for BP to take full responsibility of the disaster and compensate all parties affected with the appropriate amount. But the $32.2 billion that they have already paid would definitely move the economy to a more efficient state even if it is still some way off the actual efficient level.

Prof's Comment

An important element in this article is the legal issues. Lawyers will make a lot of money from this. The amount paid to lawyers is a transaction cost. Will this high transaction cost move us above or below the efficient outcome? How will the large fine and additional costs impact other firms? Will the big loss perhaps make shareholders demand that the firms be more diligent?