Course:ECON371/UBCO2010WT1/GROUP4/Article 1: Subsidizing Electric Vehicles

Article 1: Subsidizing Electric Vehicles

Summary

EV 2010 concluded its third annual conference and trade show on September 16 in Vancouver, British Columbia. The EV 2010 conference brought together the world’s leading industry professionals in the electric vehicle (EV) market, which enabled professionals to collaborate on the latest EV technologies, business partnerships and to discuss policy initiatives from the Pembina Institute. At the forefront of the conference was a profound sense of optimism that Canada and the Global economy can transform their transportation methods into greener EV technologies.

The Pembina Institute envisioned that 20 years from now 1 in 3 (1 million) vehicles on BC’s roads would be electric. Pembina policy analyst Katie Laufenberg exclaimed that, “EV’s offer a tremendous opportunity to transition away from fossil fuels.” This transition away from fossil fuels will equate to a reduction in oil demand within Canada by 12 million barrels-a-year and will reduce GHG emissions by 7%.

As the conference touched upon the far-reaching aspirations of a greener tomorrow, the practical steps in achieving the Pembina Institute’s vision are far from certain. Within the conference the issue of government intervention to help kick start greener transportation intatives were discussed. The issues of intellectual property and the need for government subsidies to enable the EV industry to flourish in Canada were at the forefront of the discussion.

Canada’s economy has a strong engineering and entrepreneurial culture, but what is created here is either bought or stolen by companies outside of Canada. The article examines the case of Azure Dynamics, a world leader in gasoline-electric hybrid systems that moved their operations south of the boarder to Michigan where their largest client, Ford Motors is located. Azure and Ford are both taking advantage of the generous state and federal grants, cheap loans, and tax benefits which are part of the 25 billion dollar U.S green energy policy. The article stated that Canada is falling behind in developing greener technologies, primarily due to a lack of incentives. BC has adopted a carbon tax policy, yet the tax revenue generated from this is not funneled back into clean energy alternatives such as EV’s in the form of tax benefits, grants, subsidies or guaranteed loans. As the University of Windsor professor and CEO of Auto 21 Peter Frise argues “the lack of a federal energy policy – and the funding to support it puts Canada at a disadvantage globally.“

The EV 2010 conference emphasized that the case for government intervention in the EV industry can be strongly made for Vancouver, BC. Vancouver would be an optimal city to adopt EV technologies, because of the tight urban environment and lack of large highways and expressways. Furthermore, the province of BC generates 93% of their electricity from renewable resources, which will allow the move to EV’s to reduce emissions overall, rather then shifting the emissions from the tailpipe to the other forms of emissions. Overall the article cited that EV adoption within Canada is attainable, but government intervention is necessary to bring Canada’s EV industry up to par with the rest of the world through incentives for EV R&D, the only thing that is lacking is the political will.

Analysis

Negative Externalities & The Coase Theorem

The article touches upon the basic need to shift our transportation methods away from fossil fuel based solutions to greener alternatives such as Electric Vehicles (EVs). The main issue is that fossil fuel powered vehicles emit harmful compounds that degrade the ambient air quality. Environment Canada estimates that automobiles discharge approximately 11% of Canada’s total carbon dioxide, 17% of nitrogen oxides, 20% volatile organic compounds and 47% of carbon monoxide. Moreover, these emissions result in the premature deaths of 6,000 Canadians a year and tens of thousands more suffer from ailments such as Brochaciltis that is linked to poor air quality.

This creates what is known as a negative externality. A negative externality occurs when markets fail to incorporate the costs of an individuals or firms actions or decisions upon another individual, or to society as whole. In this instance, the negative externality of air pollution from vehicle emissions arise. The benefits which motorists derive from traveling in their cars are not reflected within their cost of transportation (COT). Typically motorists COT is made up of fixed costs such as; lease payments, insurance, regular maintenance and variable costs such as gas and tires. The main issue within this cost structure is that doesn’t account for the damage or (cost) to society as a whole. Society as whole incurs costs of reduced air quality by the above-mentioned compounds which have a direct effect upon their health and the natural ecosystem.

The solution to this problem is to “internalize” the negative externality into the market and ensure the costs to society are reflected within the motorists cost-of-transportation. Noble Prize Economist Ronald Coase, developed what is know as the “Coase Theorem” which deals exclusively with the problem of externalities. Coase argued that in order to internalize an externality one must assign property rights. If property rights are assigned all economic actors will then be able to bargain and assign costs to other actors which cause the externality. Therefore, the market price for motorists will then reflect the cost that they incur to society as whole. Though the Coase Theorem seems overly simplistic here, there are a few requirements to the theorem. First transaction costs must be low, second the externality must be well defined and third the existence of laws and regulation that allows economic actors to recover their costs must be present. In dealing with the negative externality of vehicle emissions, the application of the coase theorem is not entirely optimal because the essence of the externality of air pollution is something that is not easily defined, the assignments of property rights can be hard to establish, and the transaction costs can sometimes be high. These problems with the coase theorem will be discussed in more detail within the conclusion of this analysis.

Reducing Emissions Through Taxation and Subsidization

In order to internalize the negative externality of vehicle emissions government intervention is needed to establish a prateo optimal equilibrium. Typically markets tend to allocated resources to the point in which marginal costs (MC) are equal to the marginal benefit (MC = MB). Yet as discussed above the MC of motorists do not reflect the added or external costs to society. Therefore, there needs to be a socially optimal equilibrium which typically tends to exist separately from the markets efficient equilibrium as discussed above (MC = MB)

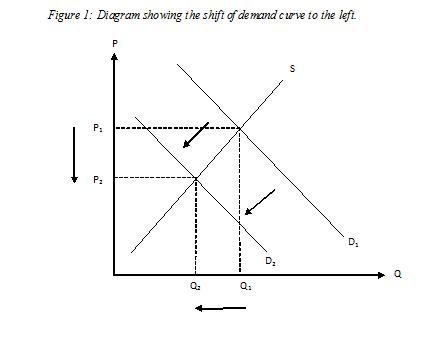

The first way to achieve a socially efficient equilibrium is to equate social costs as function of private costs and external costs (SC = PC + EC). In this case, taxation on the consumers of fossil fuels, as seen with BC carbon tax will help incorporate the social cost of vehicle emissions. This tax creates a variable costs to motorists based on the amount of miles they drive. As seen in Fig 1.1, this decreases the demand for gasoline by shifting the demand curve downwards and reducing the quantity of gas demanded thus reducing the amount of emissions.

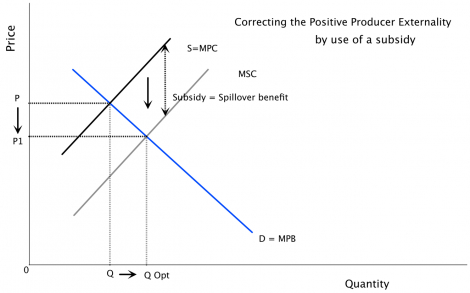

The above taxation on gasoline achieves the desire effect of reducing the amount of gasoline demanded. As stated in the article there is a need to create incentives to invest in EV R&D and carbon tax does very little to create an incentive to produce cleaner alternatives (the argument can be made that since the cost of fuel has risen, the incentive and/or payoff to explore new fuel alternatives has also risen, this is typically seen with the rise in the price of oil, as oil rises the development of higher cost oil operations come into production). Within my analysis the use of a secondary incentive to reduce emissions comes into play. The tax revenue created from a carbon tax on gasoline is diverted back into clean energy alternatives as a form of a government subsidy. This will lower the producers of EV technologies marginal cost by the amount of the subsidy given. The difference between MPC and MSC in figure 1.2 is known as a spillover benefit. This will allow EV firms to create invest more into EV R&D and provide consumer with lower product price.

Conclusion

The article argues that the development and use of EV technologies has many known benefits to society and to the greater environment as a whole. Yet the transition from fossil fuels to cleaner alternative energies needs the intervention of federal and provincial governments. The presence of the negative externality of vehicle emissions creates a cost to society which is not regulated by market forces. As discussed earlier the use of the coase theorem provides a general guideline in which we can begin to internalize the externality. Though when dealing with non-source point pollution such as vehicle emissions it becomes increasingly difficult to monetize the actual costs incurred to society and establish property rights over such a broad reaching public good as the air. The coase theorem does establish a starting point in which we can begin to tackle the problem of vehicle emissions and its effect on the ambient air quality. The use of taxation and subsidization allows us to some effect achieve a more socially efficient equilibrium. The taxation of the negative externality of vehicle emissions can also be used to to subsidize the positive externality of the EV technologies. This route will allow governments to become more fiscally responsible, and to some extent more politically acceptable then other alternatives.

Prof's Comments

Overall nice analysis. Could have used two markets, as we did in class.